A guy earning Rs 1 lacs possess higher likelihood of affording Rs 30,000 EMI , compared to an individual who brings in simply Rs.40,000 .

Now if you find yourself salaried employee, your revenue is believed getting more steady than just a guy who’s one-man shop otherwise towards the a business. Its way more easier for good salaried individual get that loan than the a self-employed person earning Rs 1 lac an excellent week to have apparent reasons.

Note:

A good amount of banks usually ask for the salary slips for prior step 1 yr and step three yrs from it returns, and you will lender report to own atleast half a year. This is exactly in order to estimate and also have a concept of your general cash moves and you may preciselywhat are their spending designs.

Many banking companies do not look at the LTA , HRA and you will medical allowances you get on the business, so that they commonly deduct those people number from the annual collect.

I imagined I’m able to speak about one crucial point right here. Actually your earnings should be things, exactly what extremely issues is your earnings into papers, that is ITR efficiency you really have filed over last dos-step three yrs. Most people do not disclose their complete earnings and you can spend less taxes, Their browsing myself impact its loan domestic qualifications.

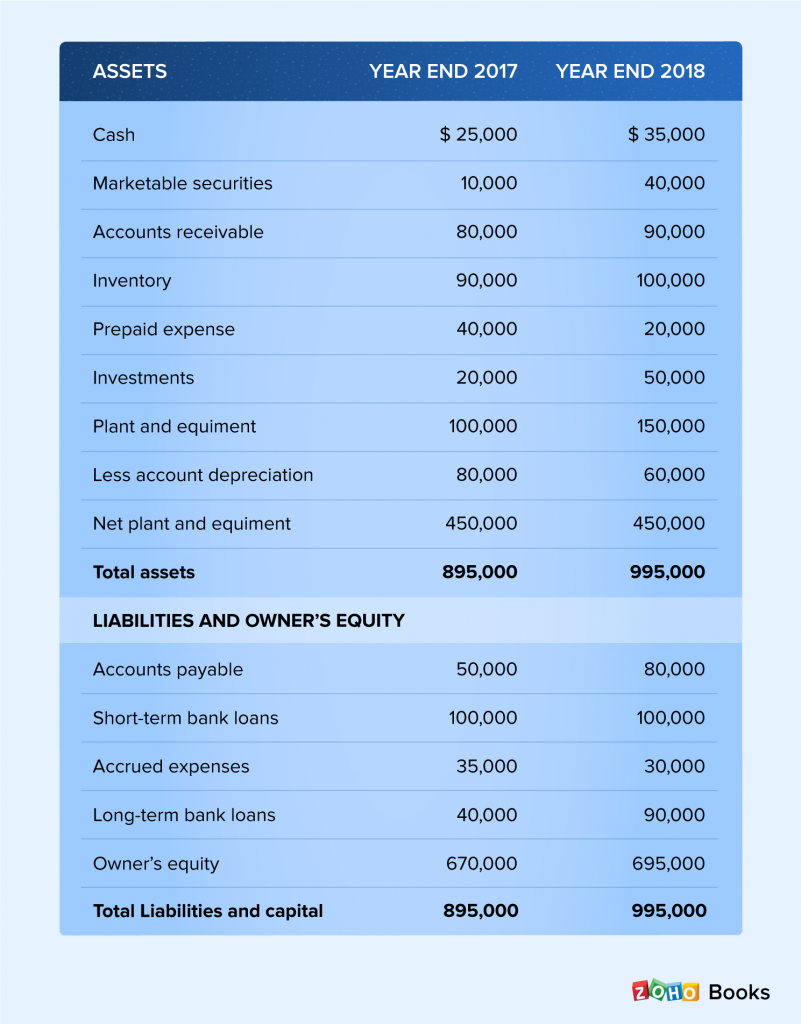

To have a self-employed Gurus, as well as the ITR’s to possess previous step three yrs, banking institutions require also Profit-and-loss statement and additionally Equilibrium layer authoritative of the a ca getting history 3 yrs.

dos. Chronilogical age of the fresh new applicant

Age the candidate also issues to some degree, but not notably. Investing a home loan try a long lasting union. And you can banking institutions need to figure out how long you could potentially pay off the brand new EMI.

A member of their 30’s will pay the loan for second 30 yrs, however, somebody who is actually 50 years old commonly retire during the sixty and contains simply 10 yrs in hand and also in one to situation, they can rating financing to possess straight down matter compared to significantly more younger individual.

Leave a Reply